On this page:

Compliance objectives

As a market regulator, we work to prevent harm to consumers and businesses through a compliance approach that strongly emphasises prevention and careful targeting of enforcement action.

By using a risk-based, intelligence-led and outcomes focused approach to compliance decisions, we can allocate our resources more efficiently, to target those that do the most harm. This enables us to act quickly against those that present the highest risk to Victorians and achieve more sustainable outcomes.

Our key objective is voluntary compliance. We proactively engage with business to inform them of their responsibilities, and assist them to make sure they know how to comply. We work to ensure the law is clear, keeps pace with changing markets, and does not impose unnecessary red-tape.

Information services to support compliance

To support voluntary compliance, we use a range of mediums to inform businesses, consumers, landlords and tenants about their responsibilities and rights. We use digital, telephone and face-to-face channels to achieve this.

This is further outlined below in the information and dispute services sections.

Information services

We are committed to making our services available through digital platforms, and will ensure the ongoing development and innovation of these services to meet the needs of all Victorians.

Our extensive website encourages consumers and businesses to proactively seek solutions to disputes and allows consumers to exercise their rights.

Where businesses and consumers need dispute assistance, our telephone-based information services are focused on areas within our direct responsibility, and form an important part of our risk-based approach to regulation. Where appropriate, we will refer businesses and consumers to the organisation best suitable to deal with their matter. For a list of other organisations that may assist in certain circumstances, view our Who to go to for help page.

Well-informed and empowered consumers and tenants drive compliance with consumer laws. We provide consumers with information and advice on their rights under the legislation we administer, and strategies to assist in exercising those rights. Similarly, businesses are advised of their obligations under the legislation that we administer, and given appropriate support to assist them in meeting their obligations.

It is important to note that as an impartial regulator, we are unable to provide legal advice to either consumers or businesses.

To ensure that our services reach all facets of consumers within the community, including the most vulnerable and disadvantaged, we financially support a number of community agencies to provide more individually tailored advocacy services. This is in line with the Government’s recognition that some of Victoria’s most vulnerable and disadvantaged citizens require additional support to access the justice system. These services are provided through a number of programs, including the Tenancy and Consumer Program and the Financial Counselling Program. For more information about these programs, view our Grants section.

Our publications provide information and advice to consumers and businesses about the legislation we administer. To download these publications, view our Forms and publications page. We continue to produce some hard copy publications, particularly in those instances where there are legislative requirements to do so.

Information gathered during our interactions with consumers and businesses during the provision of information services is a valuable source of intelligence about potential non-compliance with consumer laws.

Dispute services

In addition to our information services, in certain circumstances we provide dispute services.

These dispute services have a compliance orientation and are focused on obtaining an outcome that is consistent with the law. We seek to obtain voluntary compliance in our dispute services; we do not have binding decision making powers, nor do we have the ability to make people participate.

Our primary dispute service offering is delivered by telephone with the aim of obtaining a timely resolution. In limited circumstances, a more tailored conciliation service may be offered, based on specific legislative provisions and case complexity.

When deciding whether to offer a dispute service, we consider a range of factors, including but not limited to the following:

- Is there a likely breach of legislation we administer or a failure to comply with legal obligations?

- Is the enquiry better handled by another jurisdiction or regulator?

- Has the consumer attempted to appropriately resolve the matter themselves?

- Does the consumer detriment justify our involvement?

- Is the consumer vulnerable or disadvantaged?

- Are there other or better ways to deal with the issue?

- Has the issue already been dealt with by us or the Victorian Civil and Administrative Tribunal?

- Is the issue reasonably likely to be resolved?

Information gathered during our interactions with consumers and businesses during the provision of dispute services is another valuable source of intelligence about potential non-compliance with consumer laws.

Options to address non-compliance

We have a range of options to address non-compliance under the Australian Consumer Law and Fair Trading Act 2012 (ACLFTA), the Australian Consumer Law (ACL) and other consumer Acts.

These range from warning letters and infringement notices through to court action for the most serious matters. The tools can also be used in combination. The broad range of tools ensures that we have the flexibility to respond in a way that is both targeted and proportionate to the seriousness of the problem.

Education letter

We may send an education letter when there is evidence that a business, which may be in breach of the law, is unaware of its obligations and has generally been cooperative during interactions with the regulator.

Without prejudice discussions

We may hold an informal discussion with the business about alleged non-compliance to resolve a matter promptly, without resorting to Court or Tribunal involvement.

Business improvement engagement

We target those businesses that generate a high or disproportionate number of contacts to us for intensive compliance assistance, through our Better Business Initiative (BBI).

The BBI is a compliance program that targets those businesses that have attracted a high or disproportionate number of contacts to us or other ACL regulators. Businesses that have the potential to generate contacts, such as global companies new to Australia, are also proactively targeted.

The voluntary program helps businesses become and stay compliant. High or disproportionate contacts are considered with reference to business size and market share, and comparison with contacts generated by the nearest competitors. We are more likely to target businesses with inadequate complaints handling or those that raise other systemic issues.

We conduct a thorough analysis of contact data over time to identify issues with business conduct and their potential root causes. Face-to-face engagement with the business helps to identify changes to business practice that are likely to have an ongoing impact. The onus for making the improvements rests with the business, through an agreed action plan. We continue to engage with the business to see the plan through.

Compliance monitoring inspection

An inspection aims to detect whether there are breaches of the law. Inspections are used to determine whether enforcement action is required. We conduct a planned and targeted state-wide inspection program based on compliance and enforcement priorities. For more information, view our About inspections page.

Warning letter

A warning letter may be issued when there is evidence that a law has been broken and the business can be reasonably expected to know of and understand their obligations.

Infringement notice

This is a notice asserting a breach of the law and imposing a financial penalty. This allows straightforward breaches of the law to be dealt with by payment of a fine, rather than court proceedings. For more information, view our About infringement notices page.

Public statement

The Director has the power to make public warnings about consumer risks from unsatisfactory goods and services or unfair business practices, and a general power to educate and inform people on fair trading issues. This includes identifying individuals or businesses where this in the public interest. Public statements can take a variety of forms, including:

- consumer warning notices concerning particular products, sectors, practices, businesses or other consumer risks

- industry warning notices outlining our intentions for compliance activities

- reporting contacts, disputes, infringements or other data and information held by us

- public notification of the commencement of court proceedings or the outcomes of proceedings.

Public statements are a particularly timely and effective tool to prevent ongoing consumer harm where the issue is widespread, and in instances where we have issued court proceedings which can be lengthy. A public statement provides an immediate option for both informing consumers and deterring businesses from engaging in similar conduct.

Enforceable undertaking

This is an administrative alternative to court action. An undertaking is a document offered to the Director by the business. It generally contains an acknowledgement of the offending conduct and remedial measures, such as publicity orders and compliance programs. The undertaking is enforceable in a court. For more information, view our About enforceable undertakings page.

Asset freezing order

A court may make an order that restrains a person from dealing with their assets or those held on behalf of others, until proceedings before the court are resolved and it releases the assets.

Disciplinary action

The Director may take disciplinary action against a person or business operating under a licensing regime, which may result in the cancellation or suspension of an occupational licence, the imposition of conditions on a licence, or fines.

Civil proceedings

The Director may commence civil proceedings in a range of jurisdictions. Civil remedies available to us include:

- injunctions relating to specific behaviours

- 'cease trading' injunctions, requiring a business to cease trading altogether or to trade subject to court order conditions

- adverse publicity orders

- compensation orders

- disqualification of directors and civil pecuniary penalties. These are particularly effective in achieving specific conduct outcomes.

Criminal prosecution

The Director may institute proceedings in court on behalf of the public for the conviction and punishment of a party under the criminal provisions of the ACL and associated consumer Acts. For more information, download our Guidelines for criminal prosecutions (Word, 553KB).

Choosing a compliance option

In order to be effective, the spectrum of options to achieve compliance are wide and not only include legal actions, but all the activities a regulator uses to encourage compliance. We can use these if businesses choose not to cooperate, or where there is a serious contravention of administered legislation.

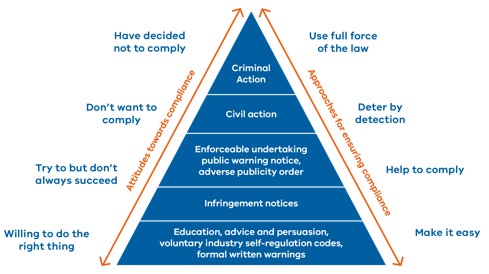

The base section of the pyramid below represents most of the activities we undertake. These are less resource intensive and thus are used more frequently to address the risk of non-compliance. These actions are premised on the assumption that most businesses want to act fairly and are willing to comply with the law. Many minor breaches of the law are caused by a lack of knowledge or capacity, and as such, we direct our resources to educate and work with businesses to improve their conduct.

The peak section of the pyramid represents the activities that we undertake the least: criminal and civil court actions. These activities are extremely resource intensive and reserved for matters posing the highest risk, particularly if the conduct is blatant and ongoing.

Considering the public interest

We exercise our regulatory powers in the public interest. In enforcing compliance with consumer laws, we aim to serve the public at large by pursuing outcomes that maintain competitive and fair markets for all consumers. For this reason, there must be a public benefit for every enforcement action. We do not act for an individual person solely to obtain redress on their behalf. Our objectives in taking an enforcement action include to:

- stop the unlawful conduct

- ensure future compliance

- raise awareness of the law

- deter and punish wrongdoers.

A consideration for public interest is also the efficient use of public resources such that:

- the resource cost of a particular action is relevant

- the use of lower cost compliance tools will be favoured where these can address non-compliant conduct effectively without resorting to more costly court action

- a broad legislative or regulatory response may be more appropriate.

Exercising discretion on case selection

In selecting matters appropriate for enforcement action, we exercise discretion, taking into account the merits and circumstances of the case, whether it is within our jurisdiction and/or enforcement priorities, and the likelihood of a conviction.

Factors that make enforcement action likely, include:

- the seriousness of the conduct – where there is evidence of, or potential for, significant consumer harm, and particularly where this conduct is ongoing

- a blatant disregard for the law, or pattern of deliberate non-compliance by the business that suggests a risk of future misconduct

- special circumstances, such as conduct affecting vulnerable or disadvantaged groups

- if the conduct is industry-wide, involves a new or emerging issue or has a significant impact on market integrity

- if enforcement action is likely to have a worthwhile educative or deterrent effect

- if court action would be advantageous in determining the extent of jurisdiction, meaning or application of the law

- if other enforcement options are not considered to be appropriate to address the alleged conduct.

Examples of what we usually do not act on, include:

- one-off, isolated events of low detriment

- matters that are more effectively dealt with by another agency

- matters of individual redress that are better dealt with between the parties through a private right of action or under an industry dispute resolution option.

Exercising discretion on jurisdiction

The Director also has discretion to choose the jurisdiction in which to commence an enforcement action.

This discretion arises from direct powers to commence legal action under the ACLFTA, ACL and industry-specific legislation, as well as from the Director’s general powers to commence proceedings.

The Director will determine the course of action that has the best chance of effectively achieving our objectives for the given matter. Other considerations are the cost and legal process requirements involved. There are three (at times overlapping) dimensions to this discretion:

Civil action and/or criminal prosecution

Key consumer protection legislation, including the ACL, creates both civil obligations and criminal offences, with considerable overlap between the two.

Our current practice is to make extensive use of the civil jurisdiction because it enables us to obtain a broad range of orders such as disqualification of directors, corrective advertising, declarations and civil pecuniary penalties. Under the ACL, we can often obtain the same penalty for a civil pecuniary penalty offence with civil action as we could with criminal prosecution.

We will make use of the criminal jurisdiction when it is the most effective option, including considering whether a conviction, a fine, or imprisonment (where available) is appropriate.

The choice to commence action under State or Commonwealth law

In the context of a national consumer protection framework, there is a priority on pursuing action in the Commonwealth jurisdiction under the ACL. This achieves national consistency and benefits for consumers in all states and territories. Joint action in collaboration with other ACL regulators can achieve effective outcomes where businesses operate across multiple jurisdictions, or different businesses are engaging in the same conduct in multiple jurisdictions.

The court or tribunal in which to commence actions

Courts and tribunals differ in the sanctions and remedies they are able to impose. Action in higher courts may be more appropriate where there is a need to establish precedent, where the consumer detriment is substantial, or where more severe penalties are sought. Other considerations include differences in the cost, time and expense involved in taking action, and whether a high public profile is sought for a matter.